This article has been written by WoodSolutions to consolidate the findings of research performed for the Timber Framing Collective (March 2023) prepared by Footprints Research.

Why do the research?

The objective of this research was to investigate and interpret consumer and user perceptions and attitudes of timber framing and their awareness of campaigns promoting its use. The questions this research aimed to answer were:

- Do you have any awareness of recent timber framing campaigns?

- What are your perceptions of different framing types and methods?

- Do you know much about timber framing's environmental credentials? If you do, what impact does this have on your decision-making?

- What other factors influence you to choose timber framing over other materials?

The goal of this research was to provide valuable insights into consumer preferences and industry trends, helping stakeholders in the timber industry to support sustainability initiatives, enhance industry marketing strategies, and improve communication between builders and their clients.

How did they do it?

The research was conducted online through an independent research panel. 220 consumers who have either built their homes within the last two years or plan to build within the next 18 months were contacted from December 2022 to January 2023. The researchers also spoke to 105 residential builders on a panel. The survey also went out through external industry association contacts to 77 carpenters and builders from January to March 2023.

What did consumers say about timber framing?

The consumer responses highlighted the importance of cost, speed of installation, and environmental credentials when choosing preferred materials for house framing. In fact, 59% of respondents said that environmental credentials are an important part of the building process, but as many Australians are concerned about the economy, they also reported that while providing materials that are good for the environment is important to them, cost is also increasingly important and fewer would prioritise sustainability if there was an extra cost.

Shifting perceptions from consumers and why

There is a general positive sentiment towards the timber industry (53%) and its environmental impact as well as a strong appreciation and value of timber’s sustainability and carbon-storing attributes. While consumers continue to rate steel ahead of timber because of misconceptions on strength, weather proofness, durability, and reliability, the strength of this sentiment is decreasing as they shift more toward ‘no difference’ between the two.

People also felt that the advertising they did see effectively promoted the benefits of timber framing and the emphasis on sustainability resonated well. While sentiment is positive toward campaigns (75%), there was a relatively low recognition of the advertising which suggests that clearer, more impactful, and always on communications could enhance consumer awareness and engagement with any timber framing campaigns initiated.

Builders continue to support timber framing and sustainability aspects are increasingly important too

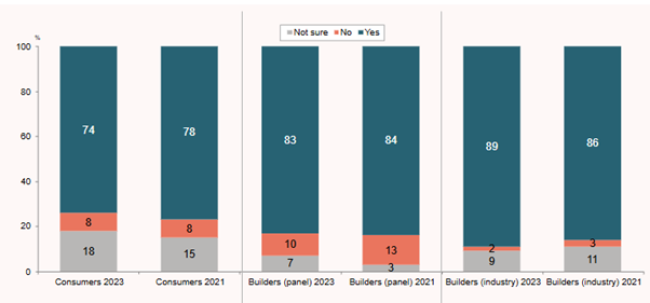

Builders and carpenters have been strong supporters and users of timber framing since the inception of the trades. They continually report their preference of timber for reasons such as ease of use, flexibility, robustness and durability, and reliability. While timber framing is tried and tested with builders, the research did show that sustainability credentials are growing in importance among this audience as well. There was a 48% increase in the importance of sustainability credentials among builders as well as an increase in positive sentiment toward the timber industry with 75%-83% of builders indicating they feel favourable towards the industry.

Q: Thinking about the materials you use or purchase as part of the building process, how much consideration do you give to the green (environmental) credentials of building materials, assuming there is no additional cost, and the materials are in ready supply?

While sustainability is clearly an important factor to builders, they do also acknowledge the importance of cost in the decision-making process and are increasingly influenced by broader market trends.

What can we infer about how to approach communications messaging?

Consumers reported that several key aspects of the messaging resonated with their values and how they approach making decisions about their home builds. They responded positively to messages that emphasise environmental sustainability, cost-effectiveness, durability, and flexibility which reflects their values and priorities for construction choices.

The research also showed that builders appreciate the sustainability credentials of timber and acknowledge its importance for their clients. They also communicated that they value clear, detailed, and effective messaging that communicates timber framing’s environmental benefits as well as its practical advantages that align with their client’s expectations on home building projects.

What does this all mean for timber framing?

Consumers and builders agree that they would like to be given building material options that are good for the environment. Around half of builders reported that they are very likely to discuss and recommend sustainable materials to their clients and most are at least quite likely to make recommendations. This reflects consumers appetite to select a builder based on their use of sustainable materials.

Q: Would you like your builder or supplier to provide you with building material options that are good for the environment?

Timber framing offers a compelling narrative around sustainability and renewability, reinforcing its value in today’s building market. This research backs the industry’s efforts to harness this narrative, empowering builders to communicate timber’s environmental benefits more effectively to clients and promote informed material choices.

Head to the WoodSolutions Renewable Timber Framing page now to learn more about the benefits of renewable timber framing and download free resources to share.